Several well-known Venture Capital firms have recently started publishing their sustainability reports.

In a previous article, I wrote that the characteristics and strengths of companies can be identified by reading sustainability reports and analyzing sustainability data. This is even more true for VC firms. For VCs, there is no standardization for ESG/sustainability data disclosure, so they decide for themselves what data to disclose and design the sustainability report more freely than companies whose shares are publicly traded.

I recently read a sustainability report from 500 Startups. Since they have accelerator programs in several countries and invest in startups globally, they proudly report on the diversity of their portfolio company founders. According to the ESG report, 30.8% of their portfolio companies have at least one female founder (the industry average is 13%), 17.6% of portfolio companies have at least one Black/African/African-American founder (the industry average is 1.0%).

Another impressive sustainability report I read was from Energy Impact Partners.

The report comprises 73 pages and contains a large amount of detailed data on the portfolio companies. Not only aggregated figures are disclosed, but also the raw data of the individual portfolio companies. One of the data that I found interesting was the turnover rates (the average total turnover rates of the portfolio companies was 23%) - by looking details of the turnover rates, I could see the impact of COVID-19 on the startups.

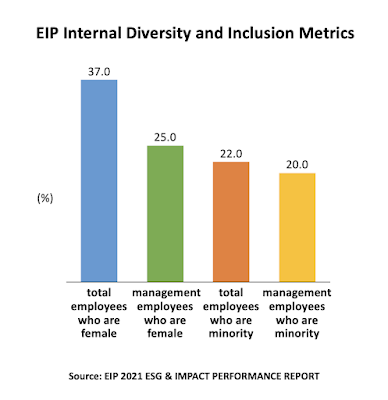

What stands out from others is that Energy Impact Partners also discloses their own organization's carbon footprint and diversity metrics. I think that's very progressive. According to the report, the percentage of female employees at EIP is 37%.

There is often criticism that the VC industry lacks diversity (lack of gender, racial diversity etc.). With the publication of sustainability reports, VC firms have started to look not only at the sustainability and impact of their portfolio companies, but also at their own sustainability, and I think that's a great thing for the industry as well.